Ayyappa Swamy Ringtones Download – Free Mp3 in High Quality

Are you looking for Ayyappa Swamy ringtones download in high-quality…

Are you looking for Ayyappa Swamy ringtones download in high-quality…

Aviator is probably the most popular gambling game in India…

Looking for the best Hindi ringtone download MP3 options? You’re…

If you are looking for a Hanuman Chalisa ringtone download,…

Sandese Aate Hai Border 2 Ringtone is a soulful and…

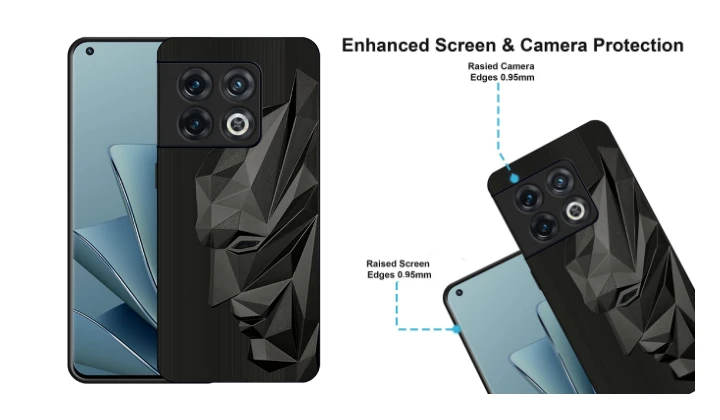

If you own a OnePlus 10 Pro, protecting its premium…

Ve Ja Tere Vas Di Na Gal MP3 Song Download…

Param That Girl Ringtone Download – Get the viral That…

Download “Sir Mukut Kundal Ringtone MP3” and enjoy the divine…